Hoboken Terminal & Yard Plan Would Create Transit-Oriented Neighborhood for City’s Southern Edge

In 1999, the owner of the NJ Devils hockey team proposed to build a $350 million arena atop Hoboken Terminal and the rail yards:

The proposal, which has been in the planning for nearly two years, envisions the creation of a new 3.3 million-square-foot complex called Hoboken Station on the riverfront amid the Beaux-Arts style arches of the historic Hoboken Terminal. In addition to the 18,500-seat arena, the complex would include a 20-screen multiplex theater, retail stores, theme restaurants and waterfront parks.

It would require completion of [a] proposed waterfront expressway project, a highway planned to run along an abandoned railroad right-of-way called the Bergen Arches from the New Jersey Turnpike through Jersey City and then to the Hoboken riverfront. But this project is still in the planning stages and without construction financing.

That plan would have destroyed Hoboken Terminal as we know it, and an extension of the New Jersey Turnpike through the Palisades to Hoboken would have destroyed the scale and character of Hoboken. A campaign by local advocacy groups ultimately resulted in a City Council resolution blocking the arena from being built over the terminal and rail yards.

Following the demise of the arena proposal, NJ Transit proposed a mixed-use redevelopment project that would permit commercial and residential towers to be built along the northern edge of the terminal’s surrounding yards. A 2005 New York Times article on the project reported that the agency had designated Pennsylvania-based developer LCOR as master planner for the rail yards:

In the process, the agency hopes to unlock the earning potential of an underused resource by adding stores, restaurants and possibly apartments on the 65-acre site. If passengers treat the terminal as more of a destination, it will in turn increase passenger trips, the thinking goes, which will generate additional revenues. Ultimately, New Jersey Transit might collect rents from tenants that never existed before.

Though few specifics have been spelled out, the idea is to make better use of idle railyards and dormant platform space, as well as sections of the terminal that have been closed to the public for decades, those involved in the deal say. A renovated terminal, they added, would also fill in a sizable gap in New Jersey’s swiftly developing riverfront.

In 2008, a draft redevelopment plan was prepared by the city using funds from LCOR and NJ Transit. Designed by FXFOWLE Architecture, it proposed 9.2 million square feet of mixed-use development that included residential buildings as high as 45 stories and a 78-story commercial tower:

That proposal was not well-received in Hoboken. It was seen as out of scale with the city’s character, and residents were concerned that the influx of people could overwhelm the southern end of the city. After a series of community meetings to gather input, NJ Transit and LCOR released a revised plan in 2010 that reduced the overall scope of the development to 2.94 million square feet: 1.5 million square feet of commercial space, 1.2 million square feet of residential space, 160,000 square feet of retail, and a 30,000 square foot performing arts space. Slides from a December 2010 public information session focused on the area around Hoboken Terminal, and showed a significantly scaled-down office tower at the corner of Hudson Place and Hudson Street:

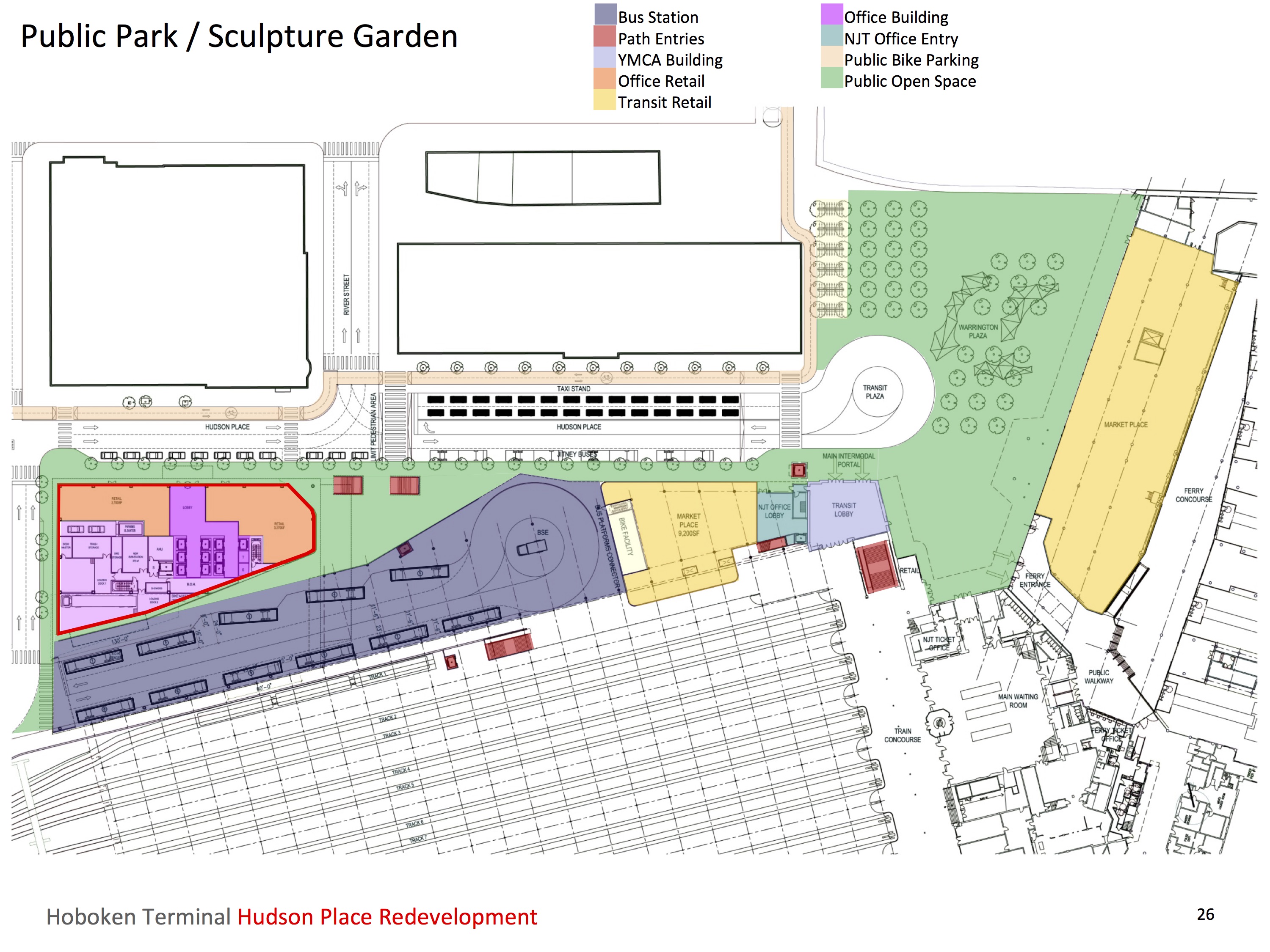

The presentation also showed plans to remake Warrington Plaza, move the taxi stand to the north side of Hudson Place, add a bike lane along Hudson Place connecting Observer Highway with the waterfront, use the access route to the current bus station as a new station with angled and parallel bus bays, reconfigure the YMCA building to provide a new main entrance to Hoboken Terminal at the corner of Hudson Place and Warrington Plaza, and build an indoor marketplace on the adjacent lot currently used for bus parking:

New Jersey’s Local Redevelopment and Housing Law enables cities to oversee the development process by adopting a plan for redevelopment after review and recommendation by the local planning board. Since the majority of the site designated for redevelopment lies within Hoboken’s municipal boundary, the City of Hoboken hired urban planning firm Wallace Roberts & Todd (WRT) to develop a city-led redevelopment plan. In September 2012, the city and WRT proposed a 2 million square foot plan that capped commercial building heights at 19 stories and included 1.4 million square feet of commercial space, 500,000 square feet of residential space with building heights capped at 12 stories, 129,000 square feet of retail, and a 23,000 square foot indoor public space reserved for a performing arts center. Lucy Vandenberg, then-executive director of PlanSmart NJ, voiced support for the plan in a 2012 op-ed:

It is important to develop underutilized sites such as the Hoboken Terminal & Rail Yards at a sufficient density to make the redevelopment plan both economically viable for private sector developers and to generate enough revenue to finance public benefits.

It doesn’t make a lot of sense for municipalities to adopt redevelopment plans that aren’t economically viable for the private sector to undertake. There are many such plans and, too often, they sit on the shelf for years after adoption.

In this case, the public has an added interest because the site is owned by a state agency, NJ Transit. Therefore, maximizing the economic benefits of the site means added benefits for the public, in the form of infrastructure improvements to the public bus terminal, new and enhanced public open space, street upgrades that would improve pedestrian and cycling safety, and affordable housing.

On October 29, 2012, Hurricane Sandy inundated Hoboken with unprecedented flooding that paralyzed the city for weeks and damaged Hoboken Terminal. As a result, the city and WRT released a revised redevelopment plan in October 2014 that includes a slight increase in commercial space to fund flood mitigation measures made necessary by Hurricane Sandy. The revised plan increases the commercial building height cap from 19 to 24 stories (vs 78 in the 2008 developer proposal), and the residential cap from 12 to 13 stories (vs 45 in the 2008 proposal). A total of 583 residential units would be built, with a minimum 10% affordable housing units, and a minimum requirement for 3-bedroom units to meet increasing demand for family-oriented space:

The City’s revised Plan calls for a baseline 2.176 million square foot mixed use project with an additional 125,000 square feet of commercial space permitted if the commercial space is architecturally creative and designed to LEED Gold standard. Two-thirds of the overall plan is for office space and one-quarter for residential space, with the remainder for retail space. The plan would create a true mixed-use project that will significantly diversify the local economy, support local businesses, and revitalize the Hoboken Terminal area and Observer Highway area – an essential gateway to Hoboken.

The plan would significantly remake the pedestrian realm around Hoboken Terminal. Warrington Plaza, named for George Warrington, the late NJ Transit executive director who led the rehabilitation of Hoboken Terminal, would be converted from its current use as a makeshift parking lot for NJ Transit police and service vehicles:

The new Warrington Plaza shown in renderings offers landscaped space for public use, events, and bicycle parking, and connects Hoboken Terminal to the waterfront promenade:

The plan reduces pedestrian/vehicle conflict near the terminal by converting Hudson Place into a two-block pedestrian plaza between Hudson Street and Warrington Plaza, with a single lane drop-off loop at the southern end of River Street. A bike lane would connect Observer Boulevard via the pedestrian plaza to the existing waterfront bike lane parallel to Sinatra Drive.

During a presentation to the Hoboken City Council in October, Brandy Forbes, the city’s Director of Community Development, noted that the revised plan takes into account resident concerns about infrastructure burden, parking, and open space. The plan will encourage parking in garages included in redevelopment, and discourage on-street parking on streets in the immediate vicinity of the redevelopment. Among the options Forbes said the city is considering: possibly not providing on-street parking permits to residents of buildings in the development, providing some free parking in building garages, and potential city management of garages to keep parking costs down.

Forbes also noted that the single largest component of the plan is commercial space, which broadens the city’s tax base while placing less burden than residential space on the city’s infrastructure. The current plan allots 23,000 square feet for an indoor, multi-use public space. Previous plans designated this space as a performing arts center, but the current plan broadens the scope to accommodate more potential community uses.

The plan’s financial feasibility was assessed by real estate consulting firm Freeman/Frazier & Associates, Inc. (FFA). For the 583 planned residential units, FFA said the $4,239 average monthly rental was an “accurate reflection of current pricing for apartments of the quality assumed and the extraordinary location afforded by the site.” According to FFA’s analysis, rental rates for comparable Class A office space range from $28-48/square foot, and “a location as desirable as the Hoboken Yard Site” could expect to lease space for $40/square foot “given the premium often paid by tenants in LEED Certified buildings.” The firm’s analysis was also optimistic about retail rental rates, noting that the $60/square foot rate was conservative for the location. Overall, FFA’s analysis shows that the city-led redevelopment proposal would offer an above-average return relative to other projects in the New York real estate market:

The cash flow model indicates that the IRR [internal rate of return] of the project will be 12.9%. This is at the high end of the minimum range of pro forma rates of return in the New York – New Jersey Market as reported by the “Realty Rates” survey in the 3rd Quarter of 2014. These minimum rates of return ranged between 11.42% and 12.96% depending on the use. These minimum pro forma rates reflect forward looking revenue and development costs and are used as a measure of viability by lenders, investors and developers.

At its meeting on December 2, the Hoboken Planning Board concluded that the 2014 plan complies with the city’s master plan, and recommended that the Hoboken City Council vote on its adoption. An NJ.com article about the planning board meeting noted unnamed residents’ concerns about the proposed building heights, but Planning Board Commissioner Daniel Weaver was optimistic about the role the buildings could play in enhancing the southern end of the city:

“There are different characters within Hoboken,” he said. “There’s nothing to move people down there. I think it has real potential to be a great addition to the city.”

For over a century, Grand Central Terminal, Hoboken Terminal, and Penn Station have served as steadfast anchors of New York’s transportation system, and their presence makes the land around them among the most important in the region for transit-oriented development. Their importance – both to their surrounding neighborhoods and the wider region – demand that major projects like One Vanderbilt, Hudson Yards, and Hoboken Yards are models for good development. The current plan for Hoboken Yards creates a true urban neighborhood at the southern edge of Hoboken that appropriately balances the city’s scale and context with the opportunity – and responsibility – to build sustainable, transit-oriented development that benefits the city and region.